Fully decentralized

Trustless

Ethereum is a bleeding edge decentralized technology. This makes it an incredibly robust network and is guaranteed to remain online for as long as at least a single user continues to participate in the network, and cannot arbitrarily and unexpectedly be shut down. The community itself is ultimately in charge. In decentralized applications, Ethereum also extends its capabilities to innovative platforms like Ethereum casinos. Leveraging the same robust technology, Ethereum casinos embody trust and transparency. By harnessing the power of Ethereum's technology, these casinos offer a cutting-edge and innovative approach to online gambling, making them a top choice for those seeking the best Ethereum casino experience.

Transparent

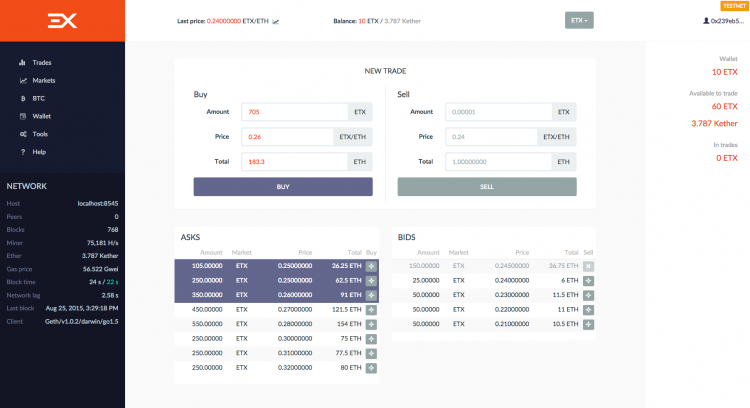

Since EtherEx is based on Ethereum’s smart contracts, all of its operations are open and viewable on the Ethereum blockchain. It is these smart contracts that allow people to interact with the exchange and its users on a trustless basis, making it a safer and more secure experience for everyone.